This week saw the announcement of a 1.25% increase in the main and higher employee class 1 national insurance contribution rates. Whilst student loans and national insurance don’t impact upon each other this is a good opportunity to review what the total burden of tax (and pensions) on graduates will be in 2022/23 and how this will differ from those without student loans to repay.

In the below we compare Plan 2 student loan holders with those without student loans and assume the following:

- That both contribute 5% of their salary into a standard auto enrolment pension

- That student loan repayment thresholds rise next year in line with recent historical precedent

- That the employee class 1 national insurance contribution threshold remains unchanged at £9,568

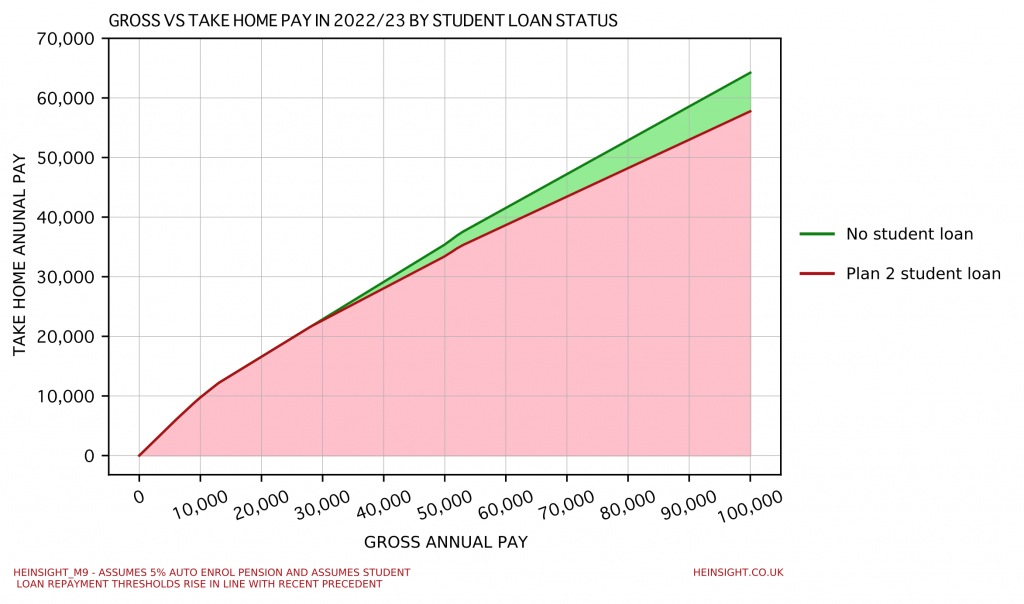

We can see the divergence begin between our two individuals as they pass the Plan 2 repayment threshold at approx. £28,000 and widen from here on out.

| Gross annual pay | Take home annual pay – no student loan | Take home annual pay – Plan 2 student loan |

| £25,000 | £19,719 | £19,719 |

| £50,000 | £35,406 | £33,429 |

| £75,000 | £50,050 | £45,823 |

| £100,000 | £64,238 | £57,760 |

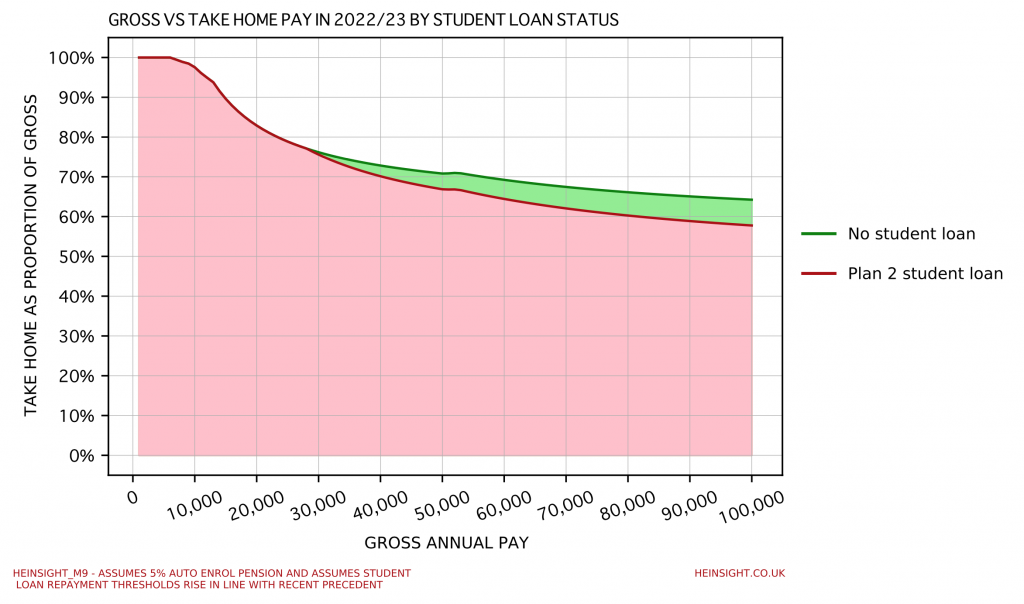

If we plot take home pay as a percentage of gross pay we can see the proportional burden of tax, student loan and pension on our two individuals.

| Gross annual pay | Take home % – no student loan | Take home % – Plan 2 student loan |

| £25,000 | 78.9% | 78.9% |

| £50,000 | 70.8% | 66.9% |

| £75,000 | 66.7% | 61.1% |

| £100,000 | 64.2% | 57.8% |

As ever larger segments of the young working age population find themselves burdened by student loans repayments it is essential that these student loans are included in discussions about changes to tax structures, or else we risk badly misjudging the impact of such changes on graduates.