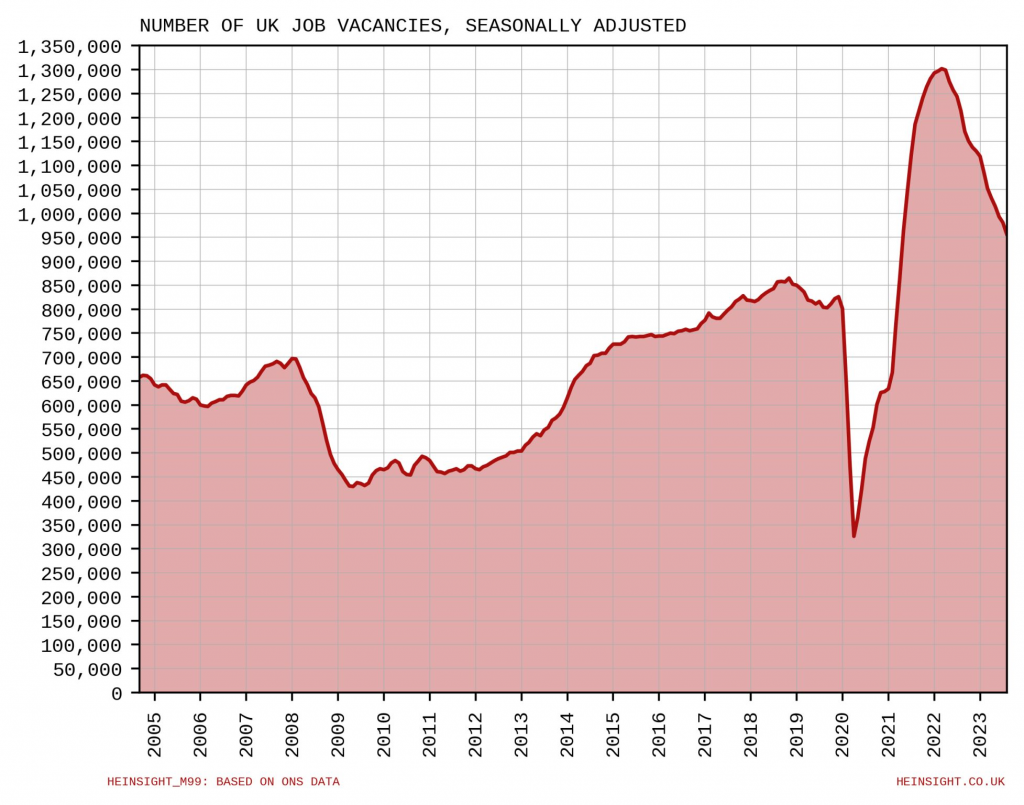

Fresh UK labour market data out today that demonstrates the extent to which labour shortages and poor health are holding back the economy.

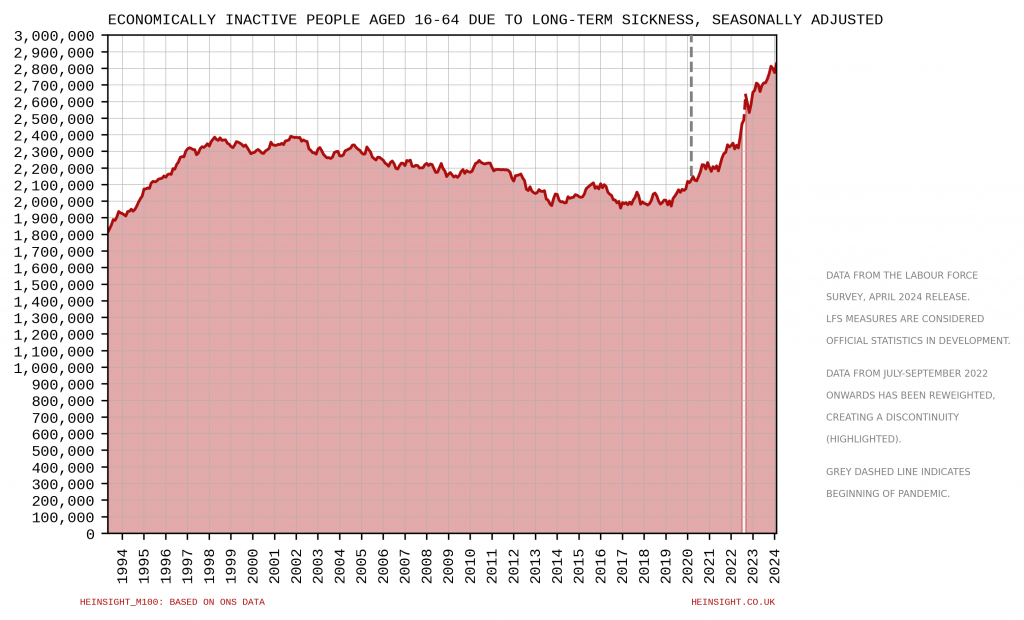

Unemployment figures alone don’t give a full view of what’s happening – we need to look at the full range of reasons people are excluded from the workforce. The big thing that’s changed? The enormous rise in the number of working age people inactive due to long-term sickness.

On the eve of the pandemic there were estimated to be 2.1 million such people. Now, there’s estimated to be 2.8 million, the most there’s been for at least 30 years and an increase of 45% since April 2019.