As the FT reported on Monday (paywall), the government is said to be considering lowering the student loan repayment threshold to £23,000, down significantly from a little over £27,000 as it currently stands. It remains to be seen if, in the event that this comes to pass, the government attempts to apply these changes retrospectively to those already holding Plan 2 loans or settles for establishing these new terms for new graduates or new students, perhaps alongside other headline grabbing changes to HE funding recommended by the Augar Review.

If the threshold is lowered to this figure however then those subject to it will feel the impact on their take home pay particularly strongly in the next tax year thanks to it coinciding with the previously announced rise in national insurance rates (see here for our previous work on this topic).

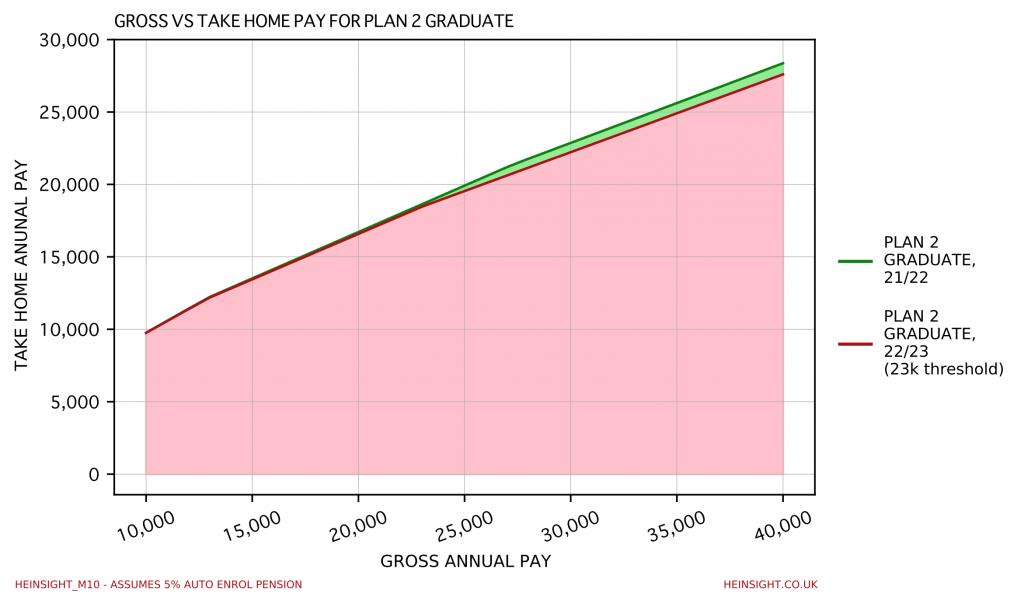

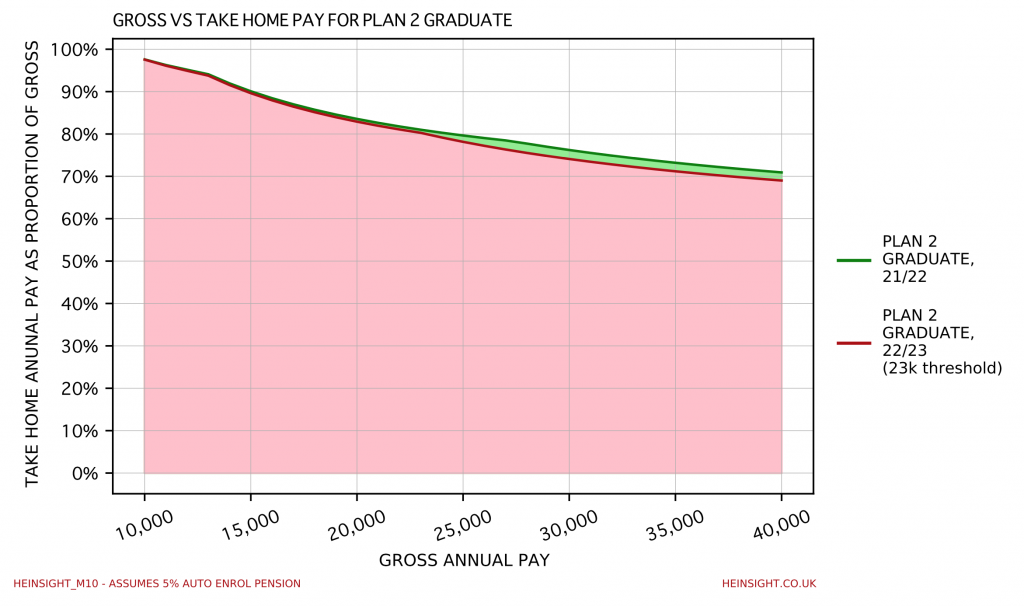

The two changes together would shave around £640 a year off the take home pay of a graduate earning £30,000, or around £53 a month, compared to the current tax year.

Assuming a standard 5% auto enrolment pension, our graduate on £30,000 would go from taking home 76.2% of their gross pay to taking home 74.1% of it.

With high inflation already eroding living standards any move to extract further bonuses for the Treasury from young workers would no doubt prompt future school leavers, especially those from the most disadvantaged backgrounds, to reconsider if higher education is worth the price.